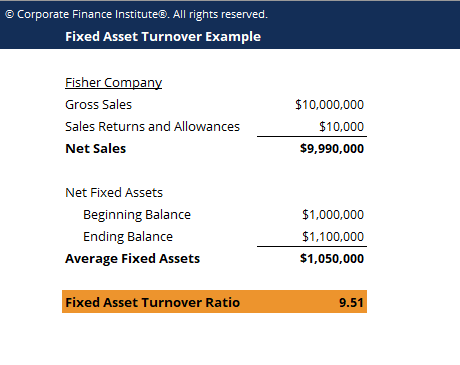

Hence, sales value should be net of any taxes.Sales value should not include any tax amount collected from customers.Hence, Net sales have to be considered.Any goods returned from the customers (Sales Return) have to be reduced.We need to consider both, cash sales and credit sales as part of the numerator.Any unrelated income (such as interest income on deposits with banks) should not be included in the numerator.Sales refer to normal revenue that the company generates from its core operation.We take a simple average of total assets as at the current period-end and previous period-end.īelow aspects has to be kept in mind while calculating the numerator and denominator. The Average total asset can be calculated from the company’s balance sheet. It is nothing but the revenue company generates after reducing sales returns, if any. Net Sales can be easily obtained from the company’s income statement. We take Net Sales in the numerator and Average total asset in the denominator. Asset turnover ratio formulaĪs seen in the image above the formula for the total asset turnover ratio is quite intuitive. This helps in determining if the company is asset-heavy or asset-light. It indicates how much revenue is the company making from each dollar of assets. The asset turnover ratio tries to build a relationship between the company’s revenue and the company’s overall assets. The total asset turnover ratio is yet another important activity ratio that measures the efficiency of the company in utilizing the assets as part of its operations.

0 kommentar(er)

0 kommentar(er)